Being Flexible: More Tips for Selling Your Business

Selling a company will not happen overnight. While a quick closing does happen for some, there are plenty of successful businesses out there that take months or years to sell. Understanding how to best prepare for the sale of your business can help you avoid mistakes and remain patient.

An important aspect of selling your business is to be flexible. So many factors are involved with selling a business, and therefore, lots of issues can come up. Being flexible means being able to work through these issues with buyers to avoid sabotaging your deal.

Price

A good Business Broker will tell you that your price needs to be negotiable. Remain willing to accept a lower offer if the reasons behind it are valid. These factors range from lack of systems, quality of management, and limited geographical distribution, to an overreliance on a handful of customers or key clients.

Compromise

Three things most business owners want when selling their business are confidentiality, the right price, and a quick turnaround. Attaining all three of these is a fairly difficult task. You might have to sacrifice price for quick turnaround, or quick turnaround for price.

Patience

Selling a business takes time. You have got to find the right person, at the right time, with the right capital. Set realistic expectations around how long it is going to take to sell the business. The fact is that stressed out owners are far more likely to make mistakes.

Redefine “winning”

Remember that old saying, “You win some, you lose some.” There will be points of contention in the selling of your business. You will lose some battles and win others, but however it plays out, it’s important to remember that a good deal (not a perfect deal) is better than no deal. Do not) lose sight of what you want to achieve: a new venture with your business sold!

Ready to sell your business? Contact us today!

Read More

The Importance of Owner Flexibility

You shouldn’t expect to sell your company overnight. For every company that sells quickly, there are a hundred that take many months or even years to sell. Having the correct mindset and understanding of what you must do ahead of time to prepare for the sale of your company will help you avoid a range of headaches and dramatically increase your overall chances of success.

First, and arguably most importantly, you must have the right frame of mind. Flexibility is a key attribute for any business owner looking to sell his or her business. There are many variables involved in selling a business, and that means much can go wrong. An inflexible owner can even irritate prospective buyers and inadvertently sabotage what could have otherwise been a workable deal.

Be Flexible on Price

A key part of being flexible is to be ready and willing to accept a lower price. There are many reasons why business owners may fail to achieve the price they want for their business. These factors range from lack of management depth and lack of geographical distribution to an overreliance on a handful of customers or key clients. Of course, one way to address this problem is to work with a business broker or M&A advisor in advance, so that such price issues are minimized or eliminated altogether.

Be Prepared to Compromise

In the process of selling your business, you may want to achieve confidentiality and sell your business quickly and for the price you want. However, the fact is that most sellers find that it is possible to have confidentiality, speed, and the price you want, but not all three. Ultimately, you’ll have to pick two of the three variables that are most important to you.

Be Patient

A third way in which business owner flexibility can boost the chances of success is to embrace the virtue of patience. By accepting the fact that businesses can “sit on the shelf” for a considerable period of time, you are shifting your expectations. This realization can help reduce your stress level. The fact is that stressed out owners are far more likely to make mistakes.

Sometimes Losing is Really Winning

A fourth way in which business owners should be flexible is realizing that you and your lawyer will not win every single fight. There will be many points of contention, and a smart dealmaker realizes that it is often better to have a good deal than a perfect deal. You may have to make sacrifices in order to sell your company. Simply stated, you shouldn’t expect the other side to lose every point.

At the end of the day, a savvy business owner is one that never loses sight of the final goal. Your goal is to sell your business. Seeing the situation from the buyer’s perspective will help you make better decisions on how you present your business and interact with prospective buyers. Maintaining a flexible attitude with prospective buyers helps to position you as a reasonable person who wants to make a deal. Goodwill can go a long way when obstacles do arise.

Copyright: Business Brokerage Press, Inc.

The post The Importance of Owner Flexibility appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

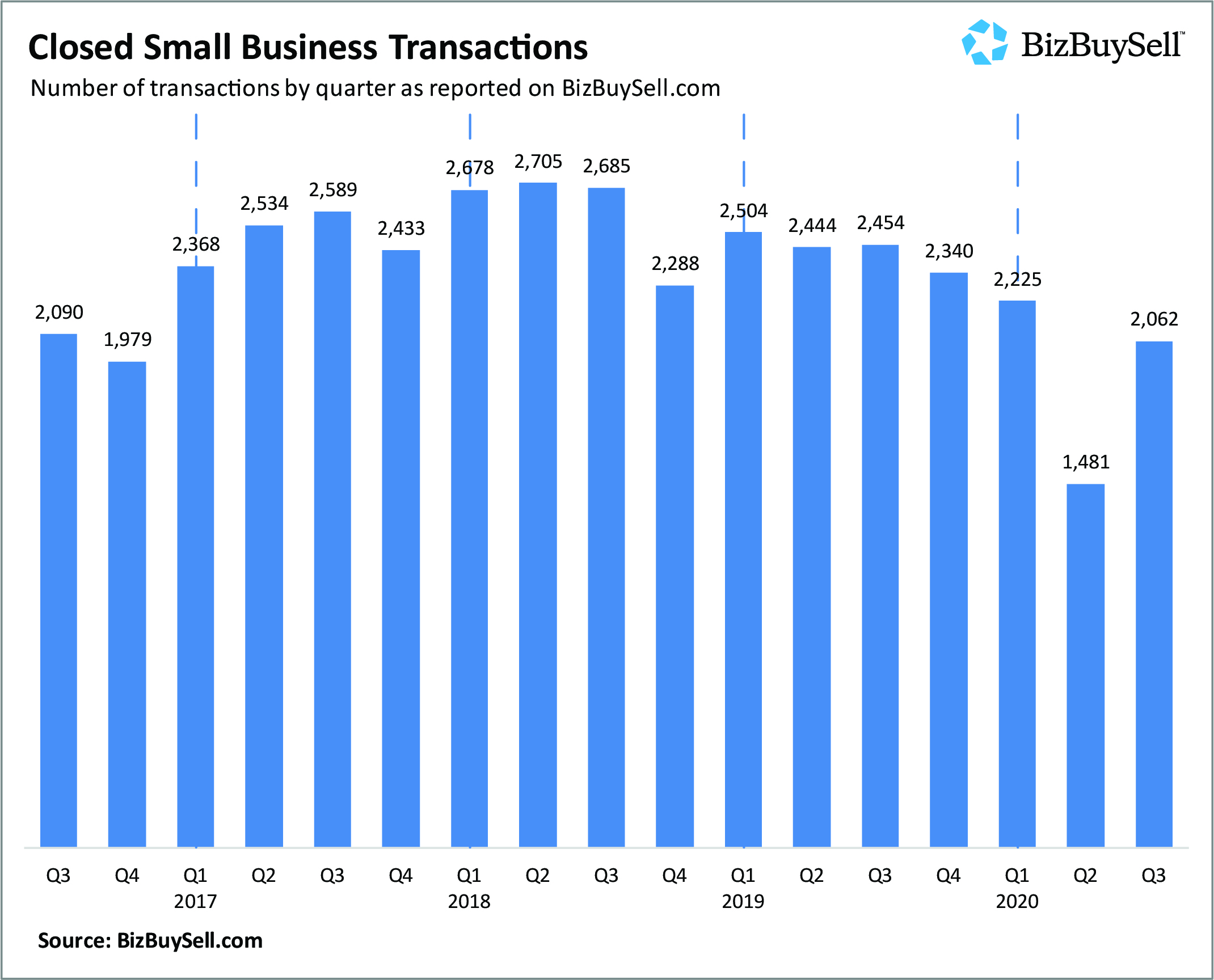

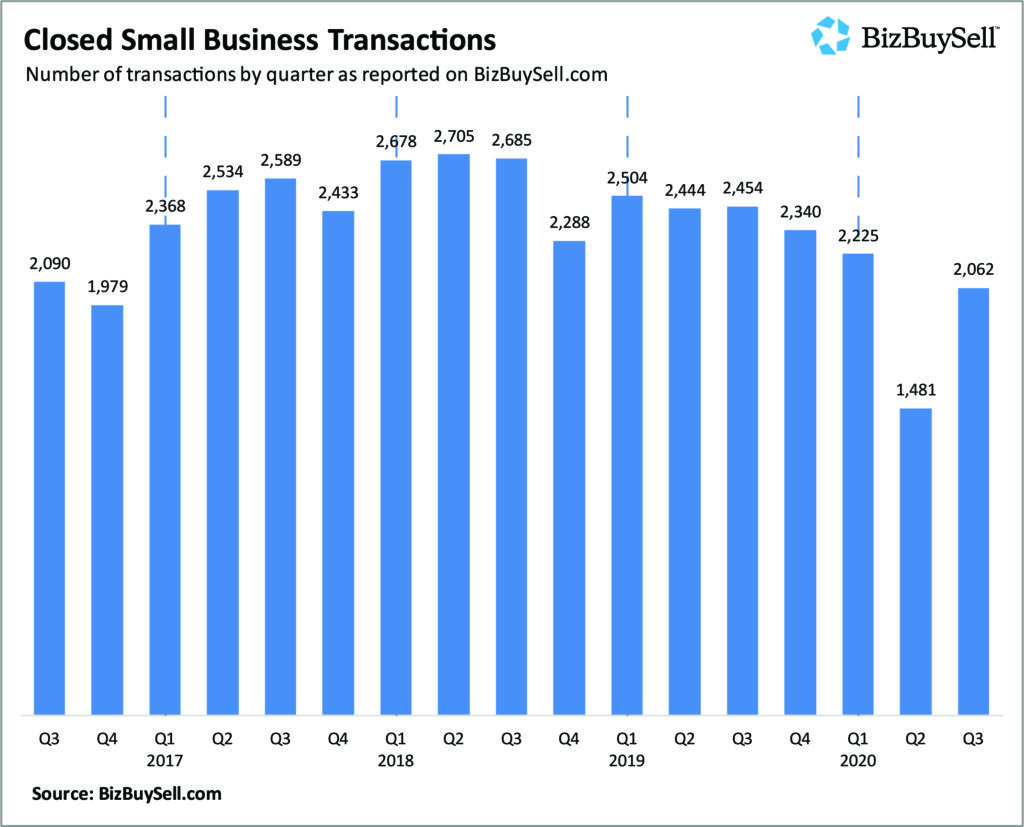

COVID-19 Impacts on Businesses for Sale

BizBuySell’s 2020 3rd quarter insight report includes statistics on Covid-19 impacts on businesses for sale in 2020. We’ve highlighted a few points from the report below. Read the full report here.

As of April 2020, sales of businesses were down 51% year over year. By July the year over year deficit was only 21% and as of September it was 5%. This shift appears to be based on consumer demand. Those looking to purchase small businesses believe they can get a better deal now than they could a year ago.

Not surprisingly, another impact of COVID-19 is that business owners’ confidence in selling their business fell. Most believe they could have gotten a better value for their business if they had sold in 2019 vs 2020.

However, the median sale price for businesses considered “essential” increased by 20%. Those businesses that are by nature “pandemic proof” (liquor stores, pet supply stores, grocery stores, fast food chains, etc.) have not decreased in value this year.

One final interesting note is that baby boomers, the group that has been the main supplier of businesses for sale, has chosen to re-evaluate lately. Due to the pandemic and the unknowns surrounding it, many have chosen to hang on to their businesses for the time being.

If you’re considering selling your business and need advice or a business valuation

3

, contact us. We’d love to help.

Read More

Goodwill for your business

For most of us, the idea of personal “goodwill” is clear. Within our own lives, “goodwill towards man” generally means doing good things for others, whether that’s volunteering, donating cash or items, or just being kind to those around us. However, in the business world, goodwill usually encompasses everything beyond tangible assets, from a business’s reputation, to the goods, services and products it provides.

Your Reputation Matters

Your business’s reputation is a key factor to your company’s success. When comparing two similar businesses, one with a stellar reputation for good service and community spirit, versus one with many negative reviews about service and support, it’s easy to identify which will be more successful. Make sure your staff knows how important your reputation is, not only for the growth of the company, but for future expansion and the eventual selling of the business too.

Going Beyond the Numbers

Goodwill is often a factor when a buyer pays more than the recognized value of a business. Variables that fall under the concept of “goodwill” include: quality and track record of management; strength of the local economy; the loyalty of the customer base; good relationships with suppliers; copyrights; trademarks and patents; name or brand recognition; specialized training and knowhow. Your broker or M&A advisor will highlight these aspects to potential buyers. Factors that impact the longevity of a business, and its long-term potential, should not be overlooked.

The Evolving Meaning of Goodwill

In recent years, the accounting profession has changed how it deals with the concept of goodwill and how it is factored into decisions. There has been a shift away from tangible assets and towards intangible assets.

Assets under the umbrella of intellectual property, including patents, trademarks, and brand names, are now considered key aspects of goodwill. In short, in the last twenty-years, goodwill has taken on a more complex and varied meaning. Today, businesses are not necessarily based around massive factories and huge assembly lines. Workers and management in the world’s largest companies 50 years ago would be hard pressed to explain the inner workings of some of today’s corporate campaigns.

In conclusion, the concept of goodwill is more confounding than ever. This factor serves to underscore the value, and importance of working with an experienced, capable and proven business broker or M & A advisor. Your business’s goodwill elements need to be highlighted so that prospective buyers fully understand the business’s real value.

Read More

Insights from BizBuySell’s 3rd Quarter Insight Report

Most business buyers and sellers are wondering what 2021 and beyond will bring. BizBuySell and BizQuest President Bob House provided a range of insights stemming from BizBuySell’s 3rd Quarter Insight Report and a survey of over 2,300 business owners.

The simple fact is that the pandemic has most definitely had a major impact on the buying and selling of businesses. This fact is obvious. But diving deeper, there are a range of insights that can be gleaned.

First, owners do understand that COVID is a massive force in business right now. According to the survey, 68% of owners feel that they would have received a better price for their business in 2019 than in 2020. Only 37% of respondents felt that they would receive a better price this year. Of owners who felt that they would receive a lower price in 2020 than in 2019, 71% of these owners said that their assessment was directly tied to the pandemic and its accompanying economic impact.

A question on the survey asked owners if the pandemic had impacted their exit plans. 55% responded that the pandemic had not changed their exit plans. Additionally, 22% said that they now planned on exiting later, and 12% stated that they planned on exiting earlier. In short, the majority of business owners were not changing their exit plans.

On the other side of the coin, buyers are acknowledging that the present seems to be a very good time to buy. A staggering 81% of buyers stated that they felt confident that they would be able to find an acceptable price point. In terms of their purchasing timeline, 72% of respondents stated that they were planning on buying a business soon. Survey follow-ups indicated that large numbers of buyers were also planning on buying in 2021.

Generational differences are playing a role as well. Baby Boomers tend to be more optimistic than non-boomers as far as their overall views on the recovery. 43% of Baby Boomers now expect the economy to recover within the next year as compared to just 30% of non-Boomers. House pointed out, “Baby Boomers are the generation that did not plan, which makes it harder for them to adjust transition plans if they were preparing to retire, as small businesses don’t have the infrastructure and management teams in place to wait out a bad cycle.”

Based on the information collected by BizBuySell’s 3rd Quarter Insight Report and their survey, it is clear that there is a new wave of buyers on the horizon. The report supports the notion that the pandemic has made small business ownership an attractive option for new entrepreneurs. Factors driving new entrepreneurs into the marketplace include everything from being unemployed and wanting more control over their own futures to a desire to capitalize on opportunities.

Finally, House notes that 2021 could be a “perfect storm for business sales,” as 10,000 Americans will turn 65 each and every day. This means that the supply of excellent businesses entering the marketplace will likely increase dramatically.

Copyright: Business Brokerage Press, Inc.

The post Insights from BizBuySell’s 3rd Quarter Insight Report appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Strategies for Successful Sales Closings

You might have heard stories about business for sale that fell through at the last minute. It’s common for people to talk about what went wrong. However, we want to talk about what can go right. There are strategies for successful sales closings that can help you sell your business.

First, it’s important that you, the seller, and your buyer are in agreement on terms. For that to happen, everyone needs to be clear about the offer itself and the terms and conditions of the sale. This can mean putting in a little more work beforehand, providing plenty of details and answers to any questions your buyer might have. You, too, may have questions about the buyer’s ability to finance the deal and his or her ability to successfully operate a business that is near and dear to your heart. Talking through these matters and getting answers to everyone’s questions sooner rather than later can lead to a successful closing.

Second, remember that patience is key. There are lots of details that go into the selling of a business. It can take time to gather all of the necessary paperwork, financial information, etc. While you should make every attempt to stick to the committed closing date, it’s important to remember that selling a business doesn’t happen overnight.

Third, there should be no surprises. As the seller, be upfront about your business’s ups and downs. It’s better for a potential buyer to be aware of shortcomings sooner rather than later. Make sure your business accounts are clean and free of any personal expenses. On the opposite side, your buyer should also be upfront about any of their financial concerns or issues. If everyone is upfront from the beginning then no one will be waylaid by surprises at the end.

Having a business broker in your corner can be helpful for utilizing these strategies to complete a successful sales. Ready to sell your business? Contact us.

Read More

Mistakes to Avoid When Selling Your Business

When you finally decide it’s time to sell your business, we know you expect that transaction to go smoothly. To make sure it does, we’ve listed some common mistakes to avoid when selling your business.

Keep up with Day to Day operations

First, don’t neglect your business while trying to sell it. It can be easy to start to let go of the business itself and to focus all your energy on making sure it sells. This can inadvertently lead to neglect in the day-to-day services and sales. However, buyers look at recent reviews and, of course, at recent sales when considering buying your company. Make sure the day-to-day items still get done even while you’re trying to sell the business.

Next, think like a buyer. If you were a buyer what would you want to see? What questions would you want to have answered before you seriously considered purchasing your business? Think like a buyer and you’ll avoid potential problems.

Be Prepared

As the Boy Scout motto says, “Be Prepare”. This is applicable to selling a business too! Make sure you have all your documents, from valuations to forecasts, etc., that a buyer will need. This not only makes the transaction go more smoothly, it gives the buyer a sense of security knowing the current owner of the business is well-organized and prepared.

Finally, don’t have blinders on when it comes to the value of your business. Accepting that a business you put your heart and soul into isn’t worth as much as you thought is a hard thing to do. However, knowing the true value of your business and making sure to market it at an appropriate price will help it to sell faster and at a price that is realistic.

Mistakes to avoid when selling your business

The common mistakes listed above when selling businesses are all reasons to use a business broker like Franchise Sellers or Company Sellers (link will be included) . We can make sure that you are prepared, that your business is priced appropriately, that you think like a buyer, and that your business continues to run smoothly while it’s on the market.

If you have questions about selling your business, email us at info@franchisesellers.tempbuilds.com.

Read More

How to find the right buyer for your business

When it comes to selling your business, it seems like the person offering the highest price is the right buyer. However, there are other factors that should be considered. Finding the right buyer for your business means looking not only at offer price, but also at motives and potential problems.

Selling to a competitor can be a great option. The competitor already knows the business and how to market it. He will be familiar with potential clients, and your own employees may be able to stay on and continue in their current roles. However, if the deal falls through, you’ve just handed the competitor quite a bit of confidential information about your business.

A financial buyer can be a good option and most likely won’t be a competitor. Unfortunately, financial buyers are planning to sell your business again in a few years, for a profit. This means they’ll be unlikely to pay your asking price.

A strategic acquirer will be more likely to pay the price you’re asking, but you have to ask yourself what their motive is. It’s possible they’re buying the business just to close it or relocate it. That may mean that your employees will lose jobs or that the business will just no longer exist. This can be difficult for many business owners to accept.

Finally, consider an employee. Often a current employee is a great option for buying and taking over your business. Problems with this situation can occur though if the deal falls

through and others at your business learn the business is for sale. Potential issues might arise too if there are many employees who don’t get along with the one buying the business.

Using a business brokerage firm like Franchise Sellers is a great option because we can help you wade through the many offers for your business. If you’re wondering how to find the right buyer for your business, a broker can take the emotion out of it and find the best option for you and your situation.

If you’re looking to sell your franchise or want to buy a franchise resale, contact us today. Looking to buy or sell a small business that isn’t a franchise? Visit companysellers.com.

Read More

Buying a Distressed Business

It is safe to state that Howard Brownstein, President of The Brownstein Corporation, is a true expert in providing turnaround management and advisory services to companies, as well as their stakeholders. Brownstein serves as an independent corporate board member for both publicly held as well as privately-owned companies and nonprofits. During his career, he has been named a Board Leadership Fellow by the National Association of Corporate Directors (NACD) and served as Board Chair and President of its Philadelphia Chapter. He also serves as Vice Chair of the ABA Corporate Governance Committee and has been named a Fellow of the American Bar Foundation. He has been a speaker at many of the world’s top universities including Harvard Business School and Wharton. Brownstein received his J.D. and M.B.A. degrees from the University of Pennsylvania.

Mr. Brownstein is considered to be one of the world’s top experts in distressed businesses. He believes it is essential to remember that not all distressed businesses are, in fact, the same. There is simply no way to know how bad things are for a given distressed business until one begins to “look under the hood,” and get a full view of what problems may lurk underneath.

Brownstein firmly believes that distressed businesses can represent a real and often overlooked opportunity for buyers. The recent economic downturn brought about by COVID-19 means that there will likely be a great deal more distressed businesses on the market in the coming months or even in the next couple of years.

Why is a Given Business Distressed?

Before you consider purchasing a distressed business, you absolutely must understand the core reasons for the distresses. Without a proper and detailed understanding of why the business entered a state of distress in the first place, it is impossible to clearly articulate why the business will potentially be valuable in the future. It is essential to be able to convey “what went wrong” and how the problems can be fixed.

Brownstein points out that while there are many reasons for a business to enter distress, two symptoms top the list. The first is cash flow issues and the second issue relates to management. Often it turns out that the management was simply not rigorous enough. He also notes that companies will tend to gravitate to external issues as a way to explain away their failure.

Of course, no two distressed businesses are failing from 100% identical causes. Brownstein suggests a series of questions that you need to ask when you begin exploring a distressed business.

- What is the business’ potential value?

- Is there something of value under the problems?

- Under better or different circumstances, could the business be viable?

These are all questions that your business broker or M&A advisor can assist with. It’s important to gain a clear understanding of the business’ past, present and future.

Copyright: Business Brokerage Press, Inc.

The post Buying a Distressed Business appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

How Should Your Company Deal with an Orphaned Product?

Keeping a product or service around that isn’t pulling its weight might prove to not be a very good idea. You may have invested a good deal of time and resources into its development, but if that product or service is no longer contributing to your bottom line, it might be time to cut it loose. Even if your product is pulling its weight, but doesn’t fit into your overall core business, then you should still consider getting rid of this “orphaned product.” Let’s take a look at some of the reasons you might want to keep or remove, an orphan product from your company.

There are four main reasons why a company might want to divest itself of a product line or service completely:

- An orphaned product line can be a distraction that takes away from core business operations.

- Funds allocated to an orphaned product could be used instead to build the core business or make improvements that are not in the current budget.

- Another good reason to remove an orphaned product from your lineup is that while it could ultimately be profitable with increased resources, the funds would be better allocated elsewhere.

- Your orphaned product could be profitable. Some buyers, companies and private equity groups are looking for product lines they can use to augment their existing ones. In fact, some buyers may even want to build a new business around a given product line.

Of course, it isn’t always as simple as “pulling the plug” and moving on. It is important to step back and consider the negative impacts of jettisoning an orphaned product, such as the fact that the product line could have key employees attached to it. Or there could be company culture issues related to removing the product, such as causing disruption within your company. You must also consider if the orphaned product could ultimately play a role in the sale of your company.

At the end of the day, an acquiring company may feel that the orphaned product line is a great fit for their existing distribution chain. Additionally, your offering might fit into a new product line that the acquiring company has launched. It is important that you evaluate every aspect of an orphaned product before making the decision to remove it from your company.

Understanding the needs and goals of your most likely buyers should play a role in your decision making. Working with an experienced business broker is an easy way to increase your chances of making the right decision.

Copyright: Business Brokerage Press, Inc.

The post How Should Your Company Deal with an Orphaned Product? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.