The Importance of Owner Flexibility

You shouldn’t expect to sell your company overnight. For every company that sells quickly, there are a hundred that take many months or even years to sell. Having the correct mindset and understanding of what you must do ahead of time to prepare for the sale of your company will help you avoid a range of headaches and dramatically increase your overall chances of success.

First, and arguably most importantly, you must have the right frame of mind. Flexibility is a key attribute for any business owner looking to sell his or her business. There are many variables involved in selling a business, and that means much can go wrong. An inflexible owner can even irritate prospective buyers and inadvertently sabotage what could have otherwise been a workable deal.

Be Flexible on Price

A key part of being flexible is to be ready and willing to accept a lower price. There are many reasons why business owners may fail to achieve the price they want for their business. These factors range from lack of management depth and lack of geographical distribution to an overreliance on a handful of customers or key clients. Of course, one way to address this problem is to work with a business broker or M&A advisor in advance, so that such price issues are minimized or eliminated altogether.

Be Prepared to Compromise

In the process of selling your business, you may want to achieve confidentiality and sell your business quickly and for the price you want. However, the fact is that most sellers find that it is possible to have confidentiality, speed, and the price you want, but not all three. Ultimately, you’ll have to pick two of the three variables that are most important to you.

Be Patient

A third way in which business owner flexibility can boost the chances of success is to embrace the virtue of patience. By accepting the fact that businesses can “sit on the shelf” for a considerable period of time, you are shifting your expectations. This realization can help reduce your stress level. The fact is that stressed out owners are far more likely to make mistakes.

Sometimes Losing is Really Winning

A fourth way in which business owners should be flexible is realizing that you and your lawyer will not win every single fight. There will be many points of contention, and a smart dealmaker realizes that it is often better to have a good deal than a perfect deal. You may have to make sacrifices in order to sell your company. Simply stated, you shouldn’t expect the other side to lose every point.

At the end of the day, a savvy business owner is one that never loses sight of the final goal. Your goal is to sell your business. Seeing the situation from the buyer’s perspective will help you make better decisions on how you present your business and interact with prospective buyers. Maintaining a flexible attitude with prospective buyers helps to position you as a reasonable person who wants to make a deal. Goodwill can go a long way when obstacles do arise.

Copyright: Business Brokerage Press, Inc.

The post The Importance of Owner Flexibility appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

COVID-19 Impacts on Businesses for Sale

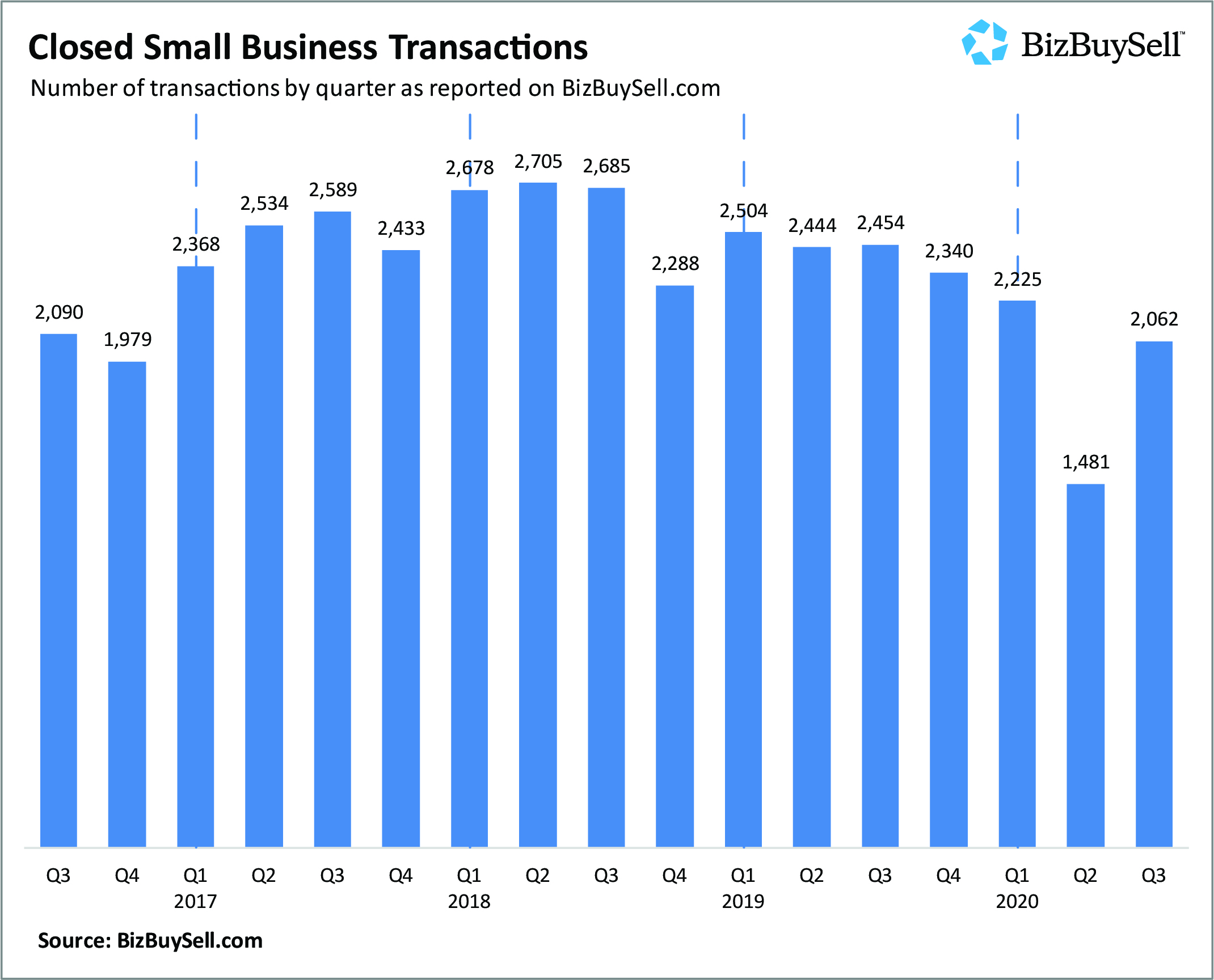

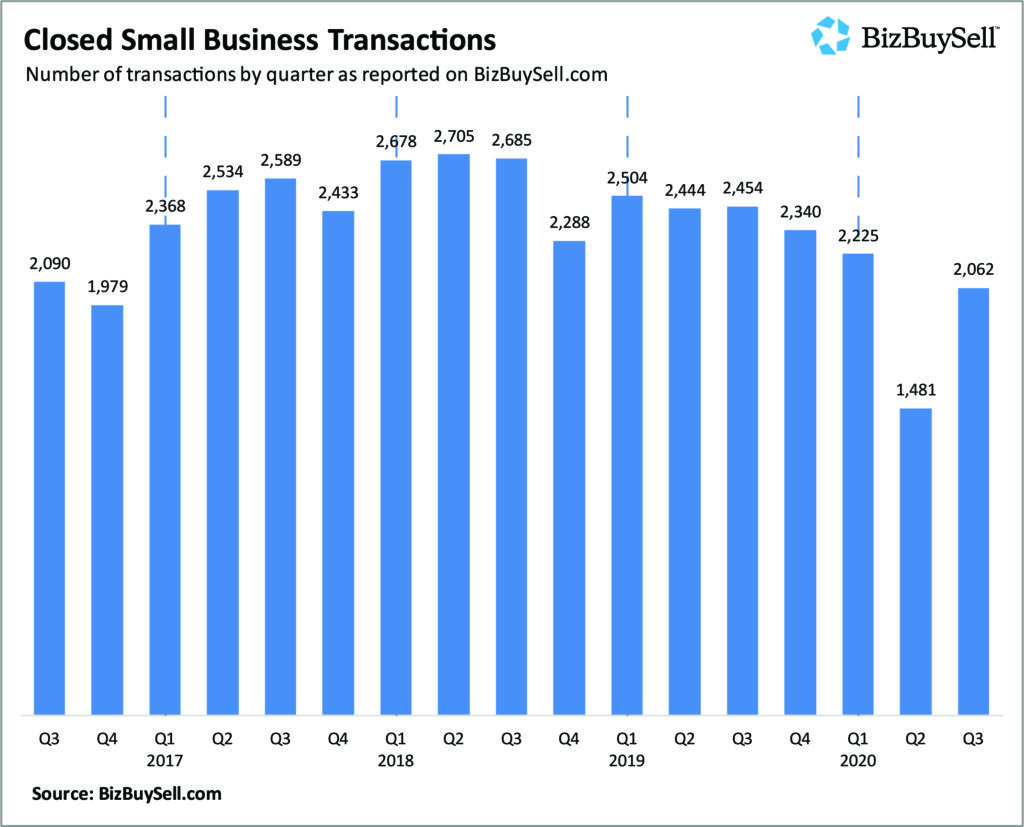

BizBuySell’s 2020 3rd quarter insight report includes statistics on Covid-19 impacts on businesses for sale in 2020. We’ve highlighted a few points from the report below. Read the full report here.

As of April 2020, sales of businesses were down 51% year over year. By July the year over year deficit was only 21% and as of September it was 5%. This shift appears to be based on consumer demand. Those looking to purchase small businesses believe they can get a better deal now than they could a year ago.

Not surprisingly, another impact of COVID-19 is that business owners’ confidence in selling their business fell. Most believe they could have gotten a better value for their business if they had sold in 2019 vs 2020.

However, the median sale price for businesses considered “essential” increased by 20%. Those businesses that are by nature “pandemic proof” (liquor stores, pet supply stores, grocery stores, fast food chains, etc.) have not decreased in value this year.

One final interesting note is that baby boomers, the group that has been the main supplier of businesses for sale, has chosen to re-evaluate lately. Due to the pandemic and the unknowns surrounding it, many have chosen to hang on to their businesses for the time being.

If you’re considering selling your business and need advice or a business valuation

3

, contact us. We’d love to help.

Read More

Insights from BizBuySell’s 3rd Quarter Insight Report

Most business buyers and sellers are wondering what 2021 and beyond will bring. BizBuySell and BizQuest President Bob House provided a range of insights stemming from BizBuySell’s 3rd Quarter Insight Report and a survey of over 2,300 business owners.

The simple fact is that the pandemic has most definitely had a major impact on the buying and selling of businesses. This fact is obvious. But diving deeper, there are a range of insights that can be gleaned.

First, owners do understand that COVID is a massive force in business right now. According to the survey, 68% of owners feel that they would have received a better price for their business in 2019 than in 2020. Only 37% of respondents felt that they would receive a better price this year. Of owners who felt that they would receive a lower price in 2020 than in 2019, 71% of these owners said that their assessment was directly tied to the pandemic and its accompanying economic impact.

A question on the survey asked owners if the pandemic had impacted their exit plans. 55% responded that the pandemic had not changed their exit plans. Additionally, 22% said that they now planned on exiting later, and 12% stated that they planned on exiting earlier. In short, the majority of business owners were not changing their exit plans.

On the other side of the coin, buyers are acknowledging that the present seems to be a very good time to buy. A staggering 81% of buyers stated that they felt confident that they would be able to find an acceptable price point. In terms of their purchasing timeline, 72% of respondents stated that they were planning on buying a business soon. Survey follow-ups indicated that large numbers of buyers were also planning on buying in 2021.

Generational differences are playing a role as well. Baby Boomers tend to be more optimistic than non-boomers as far as their overall views on the recovery. 43% of Baby Boomers now expect the economy to recover within the next year as compared to just 30% of non-Boomers. House pointed out, “Baby Boomers are the generation that did not plan, which makes it harder for them to adjust transition plans if they were preparing to retire, as small businesses don’t have the infrastructure and management teams in place to wait out a bad cycle.”

Based on the information collected by BizBuySell’s 3rd Quarter Insight Report and their survey, it is clear that there is a new wave of buyers on the horizon. The report supports the notion that the pandemic has made small business ownership an attractive option for new entrepreneurs. Factors driving new entrepreneurs into the marketplace include everything from being unemployed and wanting more control over their own futures to a desire to capitalize on opportunities.

Finally, House notes that 2021 could be a “perfect storm for business sales,” as 10,000 Americans will turn 65 each and every day. This means that the supply of excellent businesses entering the marketplace will likely increase dramatically.

Copyright: Business Brokerage Press, Inc.

The post Insights from BizBuySell’s 3rd Quarter Insight Report appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Strategies for Successful Sales Closings

You might have heard stories about business for sale that fell through at the last minute. It’s common for people to talk about what went wrong. However, we want to talk about what can go right. There are strategies for successful sales closings that can help you sell your business.

First, it’s important that you, the seller, and your buyer are in agreement on terms. For that to happen, everyone needs to be clear about the offer itself and the terms and conditions of the sale. This can mean putting in a little more work beforehand, providing plenty of details and answers to any questions your buyer might have. You, too, may have questions about the buyer’s ability to finance the deal and his or her ability to successfully operate a business that is near and dear to your heart. Talking through these matters and getting answers to everyone’s questions sooner rather than later can lead to a successful closing.

Second, remember that patience is key. There are lots of details that go into the selling of a business. It can take time to gather all of the necessary paperwork, financial information, etc. While you should make every attempt to stick to the committed closing date, it’s important to remember that selling a business doesn’t happen overnight.

Third, there should be no surprises. As the seller, be upfront about your business’s ups and downs. It’s better for a potential buyer to be aware of shortcomings sooner rather than later. Make sure your business accounts are clean and free of any personal expenses. On the opposite side, your buyer should also be upfront about any of their financial concerns or issues. If everyone is upfront from the beginning then no one will be waylaid by surprises at the end.

Having a business broker in your corner can be helpful for utilizing these strategies to complete a successful sales. Ready to sell your business? Contact us.

Read More

Mistakes to Avoid When Selling Your Business

When you finally decide it’s time to sell your business, we know you expect that transaction to go smoothly. To make sure it does, we’ve listed some common mistakes to avoid when selling your business.

Keep up with Day to Day operations

First, don’t neglect your business while trying to sell it. It can be easy to start to let go of the business itself and to focus all your energy on making sure it sells. This can inadvertently lead to neglect in the day-to-day services and sales. However, buyers look at recent reviews and, of course, at recent sales when considering buying your company. Make sure the day-to-day items still get done even while you’re trying to sell the business.

Next, think like a buyer. If you were a buyer what would you want to see? What questions would you want to have answered before you seriously considered purchasing your business? Think like a buyer and you’ll avoid potential problems.

Be Prepared

As the Boy Scout motto says, “Be Prepare”. This is applicable to selling a business too! Make sure you have all your documents, from valuations to forecasts, etc., that a buyer will need. This not only makes the transaction go more smoothly, it gives the buyer a sense of security knowing the current owner of the business is well-organized and prepared.

Finally, don’t have blinders on when it comes to the value of your business. Accepting that a business you put your heart and soul into isn’t worth as much as you thought is a hard thing to do. However, knowing the true value of your business and making sure to market it at an appropriate price will help it to sell faster and at a price that is realistic.

Mistakes to avoid when selling your business

The common mistakes listed above when selling businesses are all reasons to use a business broker like Franchise Sellers or Company Sellers (link will be included) . We can make sure that you are prepared, that your business is priced appropriately, that you think like a buyer, and that your business continues to run smoothly while it’s on the market.

If you have questions about selling your business, email us at info@franchisesellers.tempbuilds.com.

Read More

How to find the right buyer for your business

When it comes to selling your business, it seems like the person offering the highest price is the right buyer. However, there are other factors that should be considered. Finding the right buyer for your business means looking not only at offer price, but also at motives and potential problems.

Selling to a competitor can be a great option. The competitor already knows the business and how to market it. He will be familiar with potential clients, and your own employees may be able to stay on and continue in their current roles. However, if the deal falls through, you’ve just handed the competitor quite a bit of confidential information about your business.

A financial buyer can be a good option and most likely won’t be a competitor. Unfortunately, financial buyers are planning to sell your business again in a few years, for a profit. This means they’ll be unlikely to pay your asking price.

A strategic acquirer will be more likely to pay the price you’re asking, but you have to ask yourself what their motive is. It’s possible they’re buying the business just to close it or relocate it. That may mean that your employees will lose jobs or that the business will just no longer exist. This can be difficult for many business owners to accept.

Finally, consider an employee. Often a current employee is a great option for buying and taking over your business. Problems with this situation can occur though if the deal falls

through and others at your business learn the business is for sale. Potential issues might arise too if there are many employees who don’t get along with the one buying the business.

Using a business brokerage firm like Franchise Sellers is a great option because we can help you wade through the many offers for your business. If you’re wondering how to find the right buyer for your business, a broker can take the emotion out of it and find the best option for you and your situation.

If you’re looking to sell your franchise or want to buy a franchise resale, contact us today. Looking to buy or sell a small business that isn’t a franchise? Visit companysellers.com.

Read More

Price or Terms: The Structure of the Deal

An old saying in negotiating the sale of a business goes like this: The buyer says to the seller, “You name the price, and I get to name the terms.”

Another saying used to explain the actual value of the term full price: “If we could find you a business that nets you $250,000 a year after debt service, and you could buy it for $100 down, would you really care what the full price was?”

It seems that everyone is concerned only about full price. And yet, full price is just part of the equation. If a seller is willing to accept a relatively small down payment and carry the balance, a higher full price can be achieved. On the other hand, the more cash the seller wants up front, the lower the full price. If the seller demands all cash, barring some form of outside financing, full price lowers – and, in most cases, the chance of selling decreases as well. Even in cases where outside financing is used, such as through SBA, etc., the lender will do everything possible to ensure that the price makes sense.

Sellers should understand that both what they hope to accomplish in the sale of their business and the structure of the actual sale can dramatically influence the asking price. Price is obviously important, but other factors may be even more important. For example, consider a seller with health issues who needs to sell as quickly as possible. In his case, timing becomes more essential than price. Another seller may place more importance on her business remaining in the community. In her case, finding a buyer who will not move the business may supersede price or certainly influence it.

Likewise, the structure of the deal can both influence price and be a more significant factor than price to either the buyer or the seller. The structure can dictate how much cash the seller receives up front, which may be more important than price for some sellers. On the other hand, sellers should also be aware how much the interest on their carry-back can add up to. If cash is not an immediate concern, monthly payments with an above-average interest rate may be enticing.

These examples all demonstrate the importance of the business broker professional sitting down with the seller prior to recommending a go-to-market price. During this meeting, the broker should find out what is really important to the seller, as these issues may have a direct bearing on the price.

Sellers should look at the following factors and rank them according to importance on a scale of one to five, with five being extremely important.

• Buyer Qualifications

• Full Price

• Amount of Cash Involved

• Financing

• Confidentiality

• Commission/Selling Fees

• Closing Costs

• Exclusive Listing

• How the Business is Shown

• Advertising/Marketing

• How a New Owner Continues the Business

By ranking these items and discussing them with a professional Business Broker, a seller can receive helpful advice from the broker on price, terms, and structuring the sale.

Copyright: Business Brokerage Press, Inc.

The post Price or Terms: The Structure of the Deal appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Confidential Business Reviews Should Establish Trust

When you are selling a business, your business broker or M&A Advisor will likely create a Comprehensive Business Review, or CBR. This comprehensive document can then be presented to prospective buyers once they have signed all necessary confidentiality documentation. It is essential that this document builds trust between both parties, as this will go a long way towards achieving a successful deal.

Be Honest

The bottom line is that your CBR will be 95% positive. The majority of the document will be dedicated towards selling and promoting your business. Therefore, it only makes sense to disclose some potential problems. When handled correctly, the disclosure of problems can actually be a strong asset.

For example, current weaknesses of your business could become strengths in the mind of the buyer. For example, a business with a very poor online presence represents a substantial opportunity for a buyer to improve marketing and communications. Summed up another way, don’t be afraid to include negative information, especially if that information represents an opportunity.

Sharing Information

It is important that there is an element of trust between the parties. Creating that sense of trust begins with the CBR’s seller section.

Buying a business is radically different from buying a home. When someone buys a home, they usually don’t care too much about the person who they are buying the home from. But buying a business is usually a different experience. Your buyer will want to feel as though they have a fairly clear understanding of who you are and what you are about.

In the seller’s section, the buyer should get a decent idea of who you are. Your broker or M&A Advisor will want to interview you to gain ample information to include in your CBR. Your broker may even want to find out about your family, hobbies, interests and more. You may even want to consider including photos of yourself and your family.

The bottom line is that a potential buyer should be able to pick up the CBR and get a good feel for what you are like. If no level of trust is ever established between the buyer and seller, then it will be much more challenging for the deal to be successful.

Copyright: Business Brokerage Press, Inc.

The post Confidential Business Reviews Should Establish Trust appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

How to Sell a Franchise Business

These 9 Steps Will Save Franchise Owners Tens Of Thousands Of Dollars

By leveraging the power of technology and automation, industry forms, and online advertising, there has never been an easier time for business owners to value, market, and sell their franchise business ‘on their own, but not by themselves’. In addition, by using these tips, they can save the large commissions (often 10% of the selling price) charged by full-service business brokers. Follow these steps to learn how to sell a franchise business.

Preparation For Sale

Prior-Proper-Planning-Prevents-Poor-Performance! If time is on your side, the best things that you can do to prepare for the selling process is as follows: 1) As the owner, don’t be the secret sauce. 2) Raise up other managers. 3) Cross-train. 4) Focus on branding. 5) Put systems and redundancies in place. 6) Clean up your books. 7) Normalize all wages to market value. 8) Stop paying for personal or one-time expenses through the business.

Determine Business Value

Next you’ll need to determine the fair market value of your business. There are many levels of valuation reports ranging from hundreds to thousands of dollars. In most cases, a Summary Opinion Of Value & Key Indicator Report is enough.

Create A Business Profile For Buyers

Once you are comfortable with the established value range and have decided on a ‘go to market’ asking price, you’ll need to create a 1-5 page Business Profile, which you will provide to qualified buyers. Sometimes called an offering memorandum, or Confidential Information Memorandum (CIM), the Business Profile should include a business description, history of the business, information about the franchise concept, why you are selling, financial summary, and more. Sometimes business profiles also include video interviews and tours.

Buyer Marketing

Another crucial step in learning how to sell a franchise business is advertising your business for sale on some or all of the major business for sale search portals including BizBuySell.com, BusinessBroker.net, BusinessesForSale.com, BizQuest.com, LoopNet.com, DealStream.com (formerly MergerNetwork), GlobalBX.com, Axial.net, and more depending on industry, size, location, etc. To remain confidential, you will need to sell “the sizzle” but not “the steak”. Ads must be created in a way where the reader will get excited enough to ask for more info, but cannot know exactly what business it is without inquiring further.

Buyer Management

As each buyer responds to your ads, make sure that the buyer first signs a non-disclosure statement (NDA), and that that they have the skills and financial resources required to purchase your business. Once you have qualified the buyer, you will email them your Business Profile. You will continue to reach out to each buyer until they either agree to submitting an offer, or until they go away.

Offer / Counter Offer / Due Diligence

Leaning heavily on your primary business advisors (accountants, attorneys, financial planners, business brokers, etc.), you will work with the buyer to negotiate the letter of intent, counter-offer, and asset/stock purchase agreement.

Franchisor Disclosure and Discovery

As soon as possible. upon acceptance of an offer, you will want to make sure that the buyer has reached out to your Franchisor to start the franchise disclosure, discovery, and qualification process. There are a few deadlines that have to be met before the Franchisor can approve the buyer as a new franchisee. This includes the buyer receiving the Franchise Disclosure Document (FDD) and going to Discover Day. It is common to experience a delayed because this step wasn’t taken care of early on!

Business Loan Approval

Your buyer will almost always require some form of financing, whether it be a conventional loan, asset loan, SBA guaranteed loan, factoring, home-equity loan, or seller financing. The most common business loan by far is the 7(a) business acquisition loan through the Small Business Administration (SBA). The SBA lending process is long and difficult. Make sure that the buyer is working with one or more lenders (preferably 2-3) to get loan approval. This will take 60-90 days or more. Buyers should be working with lenders simultaneous to all other aspects of due diligence.

Closing Day

The closing process is different depending on your state. It is imperative that you work with a reputable business attorney and accountant to review (or create) all closing documents. You could also engage a business broker to guide you through this process. Depending on your state, the Closing will be facilitated by either a title & escrow company, the buyer or sellers’ attorney, or a third-party attorney that represents the ‘transaction’.

Prefer to work with a professional to sell a franchise business? Franchise Sellers was originally launched in 2005 to assist existing franchise owners with the multifaceted franchise resale process. They have used that experience to create and refine a 9 step ‘Franchise For Sale By Owner Toolkit”. Franchise Sellers can be found at www.franchisesellers.com or 800-499-4280.

Read More

What You Need to Know About Foreign Buyers

There is a potentially lucrative group of buyers that many sellers don’t initially think about. We are talking about foreign buyers. While there are some hurdles to working with these types of buyers, it is important to note that there are many huge advantages as well. Let’s take a closer look.

How Are Foreign Buyers Different?

At the top of the list of ways in which foreign buyers are different is that they are often seeking a visa. Another commonality among foreign buyers, one that will surprise many, is that they may want access to the U.S. educational system.

It is common for foreign buyers to want to buy a business so that they can get their children into a particular U.S. school district or college. Sometimes the desire to be eligible for state tuition also plays a role in the selection of a business and the decision-making process. In this sense, business location takes on a level of importance that it might not have for domestic buyers.

It is important to keep in mind that there are cultural and business differences that play a role with foreign buyers. Everything from a different use of business terminology to expectations can play a role. This could impact negotiations.

What About Visas and Immigration?

One of the most important things to remember is that foreign buyers are often navigating the complex world of visas and immigration. Whether or not a visa is issued can dramatically impact whether or not a deal ultimately takes place. This fact is often built into agreements. For example, a purchase condition may be conditional upon visa approval. Nonrefundable deposits may also play a role in the process.

What Do Foreign Buyers Really Want?

Foreign buyers have been impacted by the pandemic too. Yet, some factors remain unchanged. Not too surprisingly, they will want to see that a business is profitable. In this regard, you should be able to showcase profitability in a clear fashion. You can expect foreign buyers to want to see tax returns and all the typical documentation that you’d need to provide to any buyer.

A second factor that foreign buyers are interested in is longevity. If your business has successfully operated for decades, this will be a major advantage.

Ultimately, most of what domestic buyers are looking for in a business will translate over to what foreign buyers are seeking as well. With that stated, however, there are factors that are often unique to foreign buyers. As mentioned above, navigating the often-complex visa process can add a wrinkle to the entire process.

Copyright: Business Brokerage Press, Inc.

The post What You Need to Know About Foreign Buyers appeared first on Deal Studio – Automate, accelerate and elevate your deal making.